A Solar-Powered Lone Star State?

Texas is a sunny state, so at first glance a recent claim that its Solar generation is 'reliable' and 'predictable' seems reasonable. But there is *much* more to the story.

Summary

My curiosity was sparked by a LinkedIn post extolling the reliability and predictability of Solar power for Texas.

The Texas power grid is almost completely stand-alone. It is developing into a full-scale demonstration of whether solely ‘renewable’ sources of power can keep a large, highly-industrialised state running, winter and summer, night and day.

The EIA data reveals the true picture. Solar during summer days provides useful negative Demand, but that greatly diminishes and sometimes almost disappears in winter months. And, of course, Solar ‘reliably and predictably’ disappears completely *every night* - even in Texas.

Wind generation in Texas is *on average* higher in winter than in summer, thereby superficially counter-balancing Solar. However, there are times when Wind, too, dies down almost to nothing.

Electrical energy storage would help Texas, but immense amounts would be needed to make much difference. In the meantime the lights stay on because of nuclear base-load, plus fossil-fuelled generation filling in the gaps as needed.

If Texas keeps adding more renewable *capacity*, more ‘renewable’ power will end up being constrained / curtailed. Extra Wind and Solar investments will thus achieve diminishing returns - unless immense additional flexible Demand is created to soak up the surpluses on sunny and windy days.

Introduction

I was curious when I read a recent LinkedIn post1 claiming “Solar is both reliable and predictable” in Texas, based on it “regularly provided between 10% and 16% of the peak-hour electricity needed, averaging 13.8% across those 93 days… From June 15 through Sept. 15, 2023—the highest power use period of the year in Texas”. This referenced an IEEFA2 piece from September 27, 2023.

I was particularly curious because over this summer I saw numerous LinkedIn posts on the subject of Texas’s struggles to meet record-breaking power demand during the hottest (and presumably sunniest) part of the year.

Is Texas significantly different to California, another very sunny southern US state? Because my analysis of California’s Solar Generation tells me that more and more Solar just causes more and more problems for the rest of the grid in that region3, but without providing reliable power in its planned ‘decarbonised’ future.

A major difference between the two states is that, as operated by the Electric Reliability Council of Texas (ERCOT), the Texas power grid is almost completely stand-alone. It is a full-scale demonstrator for the theory that solely ‘renewable’ sources of power can keep a large highly-industrialised state running, summer or winter, night or day.

You can really only properly understand ‘renewables’ when you analyse data spanning months and years, not just days or weeks. An analysis also cannot look just at average percentage ‘renewable’ power in a given month, for example. It needs to be granular, at least hourly, to reach genuine understanding. The LinkedIn post that caught my attention was based on very selective data - for just single hours in each of 93 days, i.e. omitting at least 23/24ths of the information.

Fortunately the US EIA collects full records for the contiguous 48 states of mainland USA. This includes hourly and daily data for individual energy sources (coal, gas, nuclear, wind, etc.) since July 01, 20184. (Of course data was distorted through 2020 and 2021 by the consequences of Covid and lockdowns, so due caution is needed.)

Again, bravo EIA! with its excellent resource. I previously used it to explore how likely it is that the plan to achieve ‘decarbonisation’ of power generation across the lower 48 states of the USA (US48) will succeed. (Answer: not very.)

I downloaded the EIA “Region_TEX.xlsx” data-book on October 9th, 2023 and have spent since then exploring it in detail to find what it reveals and then compiling this post to try to convey the full picture.

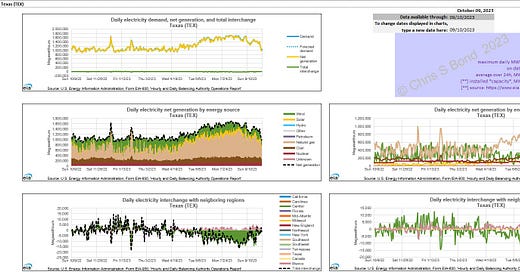

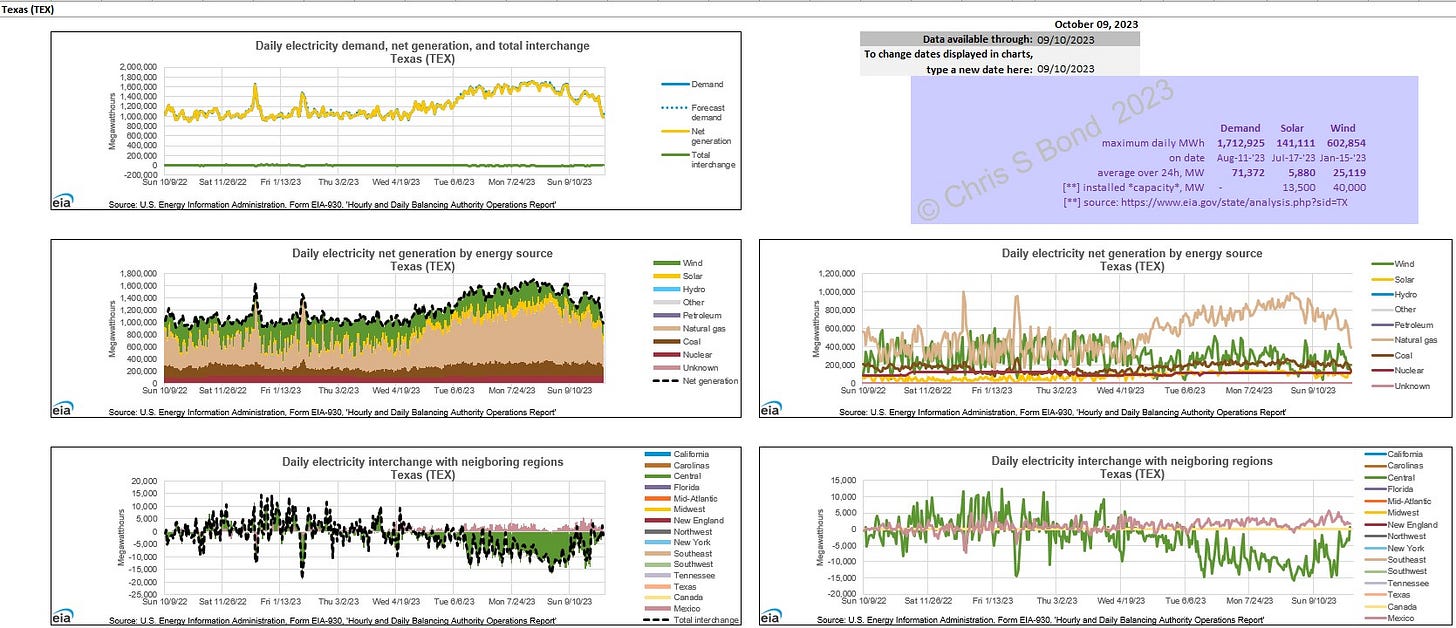

Figure 1: TEX - 12 Months to October 09 2023

Demand (top left chart) was highest through the summer. There were two other sharp spikes in Demand; one at Christmas 2022, and one around the beginning of February 2023.

From the upper right chart we see that Solar PV is *generally* low in winter and high in summer, whereas Wind is *generally* higher in winter and lower in summer.

The devil, however, is always in the detail. The instantaneous balance between Supply and Demand has to be maintained 60/24/365. If it is not, frequency control begins to be lost and the grid operator (ERCOT in TX) has to take action. If frequency is dropping, ERCOT tells generators to increase output and may ask consumers to reduce Demand. If frequency is rising, ERCOT tells generators to reduce output. Ultimately if frequency control is lost the lights would go out.

The bottom two charts of Figure 1 are interesting because at first glance they seem to imply significant electricity interchange with neighbouring areas. However, the scales are completely different. Peak Demand is around 1,700,000 MWh, whereas peak interchange is around ±15,000 to 20,000 MWh, i.e. barely 1% of Demand.

This lack of interchange capacity is by design: “ERCOT5 has limited interconnection with neighboring grids, and this has been on purpose to avoid federal regulation. This has advantages and disadvantages: Texas can make its own rules when it comes to electric power, but the amount of power that can be imported from neighboring grids during an emergency is very limited.”

The Summer Demand Peak

First I dug deeper into the interval in August 2023 when Demand reached the record-breaking high of 85,432 MWh on Thurs Aug 10. Figure 2 shows Demand (blue), Solar PV (yellow) and Wind (green) per EIA data for Texas (TEX) for 14 days from 01:00 Fri Aug 04 thru 01:00 Fri Aug 18.

Note that the energy scale is in MWh, but also that the data interval is 1 hour. Therefore the power flows in MW are also indicated by the vertical scale.

Figure 2: TEX Fri Aug 04 thru Thurs Aug 17 2023

Until the last three days of the interval, Demand varied between about 53,000 MW in the night on Sundays, to peaks around 83,000 to 85,000 MW each day. Solar PV peaked at around 12,000 to 13,000 MW each day, then reliably and predictably fell to zero for about 12 hours every night. I have added two extra plots to the chart: [Demand- Solar], and [Demand- Solar- Wind]. Every night the remaining Demand- Solar- Wind is about 35,000 to 40,000 MW, except on Tues Aug 15 when Wind went largely absent without leave (AWOL).

Zooming in on Aug 10, 2023 we can generate the plot shown in Figure 3. We can see that Solar PV was still significant (but dropping off rapidly) at around 6pm when Demand peaked. The charts of [Demand- Solar] and [Demand- Solar- Wind] treat Solar PV and Wind power as negative loads. The net Demand beneath the [Demand- Solar- Wind] chart is the electrical power that has to be provided by dispatchable controllable sources: mainly fossil fuels, plus base-load nuclear and minor amounts of hydro.

Figure 3: TEX Thurs Aug 10 2023 - Record High Demand

In the EIA Excel file, below the bottom of the data in the [Hourly Charts] tab I appended the data field shown in Table 1 so I could perform further calculations on my selected day’s data.

Table 1: TEX Thurs Aug 10 2023 - Hourly Data

The Maximums and Averages results at the bottom of the columns of data are from my calculations:

Demand 85,432 MW at 18:00; (Average 70,821 MW in that 24 h.)

Solar 12,854 MW at 13:00; (Average 5,381 MW in that 24 h.) and

Wind 18,198 MW at midnight (00:00); (Average 11,571 MW in that 24 h.)

The Solar MWh figures are from averaging the hourly Solar MWh numbers. For example, Solar at 07:00 is 2 MWh and at 08:00 is 1,299 MWh, so the average Solar energy through that interval = (2 + 1,299)/2 MWh = 651 MWh. And so on.

(All results are formatted to zero decimal places.)

The Cumulative Solar MWh column shows the total Solar energy in MWh that TEX generated through that day = 129,152 MWh; divide by 24 gives the Average 5,381 MW.

Solar Electricity Storage for the Summer Demand Peak

In order to illustrate the scale of the numbers - and keeping it simple by only considering Solar PV - I looked at the quantity of energy storage needed to maintain constant power = Solar PV Average = 5,381 MW throughout 24 hours.

I used the simple flow-scheme from my Solar Power - a Growing Problem post and adapted it for the Texas power data for August 10, 2023. See Figure 4 and Tables 1 & 2.

Figure 4: All-Texas Solar Power Energy Storage for Thurs Aug 10 2023

All-Texas Solar PV *capacity* for Aug 10 was 12,854 MWp (close enough to the summer’s 13,300 MWp at 13:00 on July 17 for illustration purposes). Instead of instantaneously injecting all that peak power into the TEX grid, consider diverting surplus above the Average to energy storage, then when Solar PV drops, export from energy storage back to the grid. This results in stresses on the broader grid (and on dispatchable generators) being greatly reduced.

(I understand that this would currently be economically *challenging*, but stay with me.)

Table 2: TEX Thurs Aug 10 2023 - Hourly Energy Storage

Solar direct use to consumers (1st column) cannot be above zero unless Solar power exceeds the 24h-average. Once it does, direct use to consumers is controlled at the 24h-average (5,381 MW in this example) while surplus is diverted to energy storage (2nd column).

The 3rd column shows the cumulative amount in energy storage: 63,261 MWh by the end of the 24h. This is the energy storage capacity required (excluding all losses / ignoring other constraints) for that day’s Solar.

The 4th column in Table 2 shows the energy that has to flow from energy storage so as to maintain the power to consumers at the 24h-average value.

The 5th column begins with the cumulative stored energy 63,261 MWh from the bottom of the 3rd column. (This assumes that the energy stored from the day before is this same value: close enough for illustration purposes.) The 5th column then counts down the energy in storage as it’s used, ending at zero - confirming the internal consistency of the numbers.

What kind of energy storage technology have I assumed? Pumped hydro, because it’s technology that’s been reliably used for decades at similarly-large scale. Measured round-trip efficiency is typically 75% (ref: Dinorwyg); the ‘safe depth of discharge’ is a level control limit designed to keep a minimum safe top reservoir level. Thus using real-world pumped hydro storage schemes as the reference we get the total energy storage = 84,348 MWh (Fig 4). We also see that this would need to charge at up to 7,454 MW (Table 2, 2nd column at 14:00). This is lower than the peak discharge rate and so defines the charge / discharge machinery.

Could there be this scale of pumped hydro in Texas? I don’t know. There are some hills out in the west but that’s a *long* way from the cities and industrial centres. The grid infrastructure would have to have at least that capacity. But I’ll assume yes. Then using the UK’s four pumped storage schemes as long-standing real comparators:

≈ 23,700 MWh of UK pumped storage (Texas ≈ 3.5 x UK)

≈ 2,860 MW total UK pumped power capacity (Texas ≈ 2.6 x UK)

A very real physical constraint on pumped storage schemes is the sheer size of each of the reversible Francis turbine machines required. Dinorwyg has six, each weighing nearly 450 tonnes for its total capacity of 1,728 MW. The shut-off valves at Dinorwyg are also “the largest ever built”.

My conclusion? All of Texas is not going to store that much electrical energy any time soon, even if it wanted to.

But I guess there must be some Texans who have a Solar PV array on their roof and are wondering how big the batteries need to be to go completely off-grid (assuming they also have power frequency control within their system). Pro-rating from the all-Texas numbers for a 20 kWp domestic setup we get the system shown in Figure 5.

Figure 5: Individual Texas Home Solar Power Storage System

I don’t know if average 8.4 kW is sufficient, but if it is the energy storage needed is around 130 kWh. For context, two electric vehicles (EVs) each with a 65 kWh battery would be needed just hooked up to their Solar panels 24/7 - forget about going anywhere in those vehicles. Or maybe one EV to store power plus a ‘coolth’ storage system for the air-con.

But in theory they could go off-grid… at least until winter.

The Early February 2023 Lull

The early February spike in Demand visible in Figure 1 coincided with an interval of low wind and low Solar PV, see Figure 6. For all but two hours from 07:00 Mon Jan 30 to 20:00 Feb 30 (i.e. a 110-hour-long interval) Wind was below 10,000 MW (from the 40,000 MW of installed Wind *capacity*). During that 110-hour interval Wind averaged 4,939 MW and Solar 1,351 MW.

Figure 6: TEX Thurs Jan 26 thru Weds Feb 08 2023

During that same 110 hours, Demand averaged 57,980 MW, and Nuclear 5,117 MW. Coal plus Gas averages summed to 45,962 MW. If that lull were to be covered by stored electrical power it would, roughly speaking, amount to 45,962 MW x 110 hours. Or roughly 5,000,000 MWh. Pumped storage with over 200 times the UK’s total? I doubt it.

Or, at USD 12.6 million for 19.3 MWh for Tesla Megapacks (Figure 7) that’d be a cool USD 3,264,250 million. USD 3,264 billion doesn’t make it seem any less. But maybe it would be somewhat less with bulk discount.

Figure 7: Megapack Cost as of 24/08/2023

More realistically, large multiples of Wind (and Solar) would be needed to replace that quantity of fossil power across a significant lull.

But then look at the right-hand end of Figure 6. Wind from late on Sunday Feb 05 through around 18:00 Tues Feb 07 was already more than half of Demand. If more than about 2 times Wind capacity was installed Texas would have to constrain Wind frequently in a windy winter to maintain grid frequency control.

Or consider the day of maximum daily Wind: 602,854 MWh on Jan15 2023. This, if averaged across 24 hours, is 25,119 MW, from an installed *capacity* of 40,000 MW.

Figure 8: Maximum Daily TEX Wind Jan 15 2023

Right there is the ‘renewable’ power conundrum. The more ‘renewable’ generation you add, the less of that incremental power generated you can use while maintaining frequency control. The law of diminishing returns writ large. Unless you have immense additional flexible reliable Demand to which you can feed the surplus.

Christmas 2022

Figure 9: TEX Weds Dec 14 thru Tues Dec 27 2022

Demand increased significantly a short time before Christmas, just as Wind stalled and the sun went off on its own vacation. I don’t know about being lonely that Christmas if you were in Texas relying on solely Wind plus Solar power, but you would almost certainly have been uncomfortably cold.

Would you like to rely on Solar + Wind under those conditions?

Conclusions

You cannot rely on a hot take from a proponent of ‘renewable’ energy to inform you whether ‘renewable’ power will reliably keep the lights on.

Analysis of the publicly-available granular data (from the EIA in the US; from GridWatch in the UK; etc.) *will* inform you if you take the time to look at it.

Texas is not going to ‘decarbonise’ its power any time soon if it relies solely on ‘renewable’ sources for its electricity.

Texas will soon experience the law of diminishing returns: the more ‘renewable’ generation *capacity*6 it adds, the less of the incremental generated power Texas will be able to use while maintaining grid frequency control.

Disclaimer: Opinions expressed are solely my own.

This material is not peer-reviewed. This is why I stopped believing it would do any good, and this reinforces that conclusion.

I am against #GroupThink, and I am very pro #FreeSpeech.

Your feedback via polite factual comments / reasoned arguments welcome.

IEEFA? From https://ieefa.org/who-we-are?tid_2%5B0%5D=14&tid_2%5B1%5D=435&tid_2%5B2%5D=14&tid_2%5B3%5D=435

"The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.”

It appears that IEEFA ‘examines’ only such data as supports its ‘mission’.

Unlike Texas, California benefits from major interconnections with adjacent power regions, largely able to export surplus electrical power or import power to cover its own shortages.

The EIA website has a “download data” button which is easy to use and gives immediate access to this comprehensive and continuous data. Each downloaded Excel workbook includes two tabs - [hourly charts] and [daily charts] - which are pre-configured. On the [daily charts] tab you see a whole-year’s picture up to a specified date, while on the [hourly charts] tab you can select the last date of a 14-day interval for which you want to see detailed data-plots.

I put *capacity* when referring to 'renewables' to emphasise that you get what you get from a Solar or Wind installation. On a good day you might get a high proportion of that nameplate amount. On a bad day / night, zip.